The R in the Fisher Effect Formula Represents the:

Which one of the following premiums is paid on a corporate bond due to its tax status. I Nominal Interest Rate.

Fisher Equation Overview Formula And Example

Set seed of 123 for reproducibility and take a random sample n50.

. SEx s n 34 34 S E x s n. The eta squared based on the H-statistic can be used as the measure of the Kruskal-Wallis test effect size. According to the above formula the approximate nominal rate of return can be calculated as 0035 0054 0089 or 89.

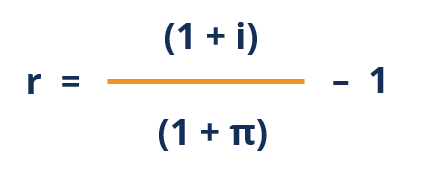

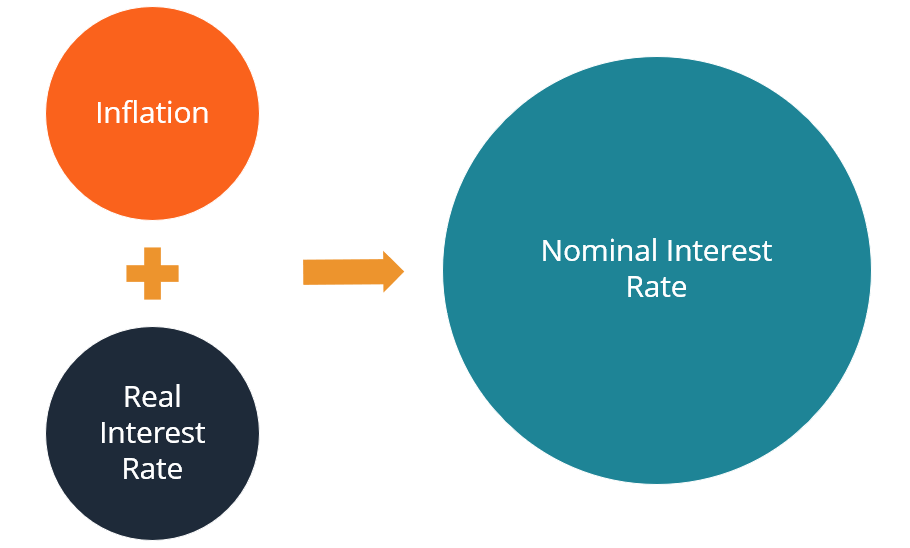

The Fisher equation is as follows. The relationship was first described by American economist Irving Fisher in 1930. Named after Irving Fisher an American economist it can be expressed as real interest rate nominal interest rate inflation rate.

The real rate of return is lower. E t h e p e r c e n t c h a n g e i n t h e e x c h a n g e r a t e i 1 c. The Fisher Effect is an important relationship in macroeconomics.

1i 1r 1π Where. To see this multiply out the right-hand side and subtract 1 from each side to obtain. The Fisher equation says that these two contracts should be equivalent.

Fishers Exact Test is used to determine whether or not there is a significant association between two categorical variables. In more formal terms where r equals the real interest rate i equals the nominal interest rate and π equals the. The variable c is the number of random effect terms in the model and 1 represents the variance.

π Expected Inflation Rate. For linear models eg multiple regression use. In other words the real interest rate is the nominal interest rate adjusted for the effect of inflation on the purchasing power of the outstanding loan.

Calculating the International Fisher Effect. Real return nominal return coupon rate. The matrix has c 1 rows and columns.

Setseed 123 sample. Question 9 1 The R in the Fisher effect formula represents the current yield from BAS 212 at Hazard Community and Technical College. K is the number of groups.

Therefore substituting the value of i and r in the formula for the Fisher equation 1 i 1 r 1 Pi the value for the nominal rate of interest is 91. R Real Interest Rate. The relation between nominal and real interest rates and inflation is approximately given by the Fisher equation.

I r π rπ. FishertestM1 Fishers Exact Test for Count Data data. IFE is calculated as.

The R in the Fisher effect formula represents the. Tomczak and Tomczak 2014. As we have seen before the mean and its standard error are easy to calculate in R.

Definition Formula and Example. In R we can use fishertest function to perform the fisher test. It is typically used as an alternative to the Chi-Square Test of Independence when one or more of the cell counts in a 22 table is less than 5.

M1 p-value 09888 alternative hypothesis. The relationship is described by the following equation. 5 Multiple Choice current yield.

The R in the Fisher effect formula represents the. Where H is the value obtained in the Kruskal-Wallis test. Eta2H H - k 1n - k.

As per the Fisher effect. What Is the Inflation Rate. I nominal interest rate r real interest rate π inflation.

E i 1 i 2 1 i 2 i 1 i 2 w h e r e. The amount of profit earned by the trader. We use the population correlation coefficient as the effect size measure.

The Fisher Effect states that. To estimate the standard errors of the variance components Minitab begins with the observed Fisher information matrix. N is the total number of observations M.

The R in the Fisher effect formula represents the. As an approximation this equation implies. M1.

The R in the Fisher effect formula represents the. It is calculated as follow. An upward-sloping term structure of interest rates indicatesA.

1 i 1 r 1 π Where. A bond trader just purchased and resold a bond. The R in the Fisher effect formula represents the.

I r π. A Two-Period Model Consumers Experiments Introduction Intertemporal Decisions Macroeconomics studies how key variables evolve over time The simplest way to think about intertemporal decisions is in a two-period model The first period is the current period or today The second period represents the future or tomorrow Key trade-off. Fishers Exact Test.

Pwrrtestn r siglevel power where n is the sample size and r is the correlation. 5 Multiple Choice 02 current yield. In financial mathematics and economics the Fisher equation expresses the relationship between nominal and real interest rates under inflation.

The Fisher Effect is an economic theory created by economist Irving Fisher that describes the relationship between inflation and both real and nominal interest rates. Real return nominal return О O coupon rate. Real rate1nominal rate1inflation rate-1 or R1i1-1 where R View the full answer Transcribed image text.

The eta-squared estimate assumes values. The value of a bond is dependent on the. Cohen suggests that r values of 01 03 and 05 represent small medium and large effect sizes respectively.

If r and π are small numbers then r π is a very small number and can safely. Coupon rate and the yield to maturity. 1 i 1 r 1 π.

Fisher Equation Overview Formula And Example

No comments for "The R in the Fisher Effect Formula Represents the:"

Post a Comment